Getting successful in fundraising with our 9 advisory modules

I) KEY TERM CONCEPTUALISATION

• DCPLA will provide guidance and expertise to fund managers, in defining and understanding the key terms and concepts that are essential for their business operations in the private equity industry.

• This advisory module will help fundmanagers navigate the complexities and nuances of various terms and ensure that they align with industry standards while supporting the overall business objectives and models.

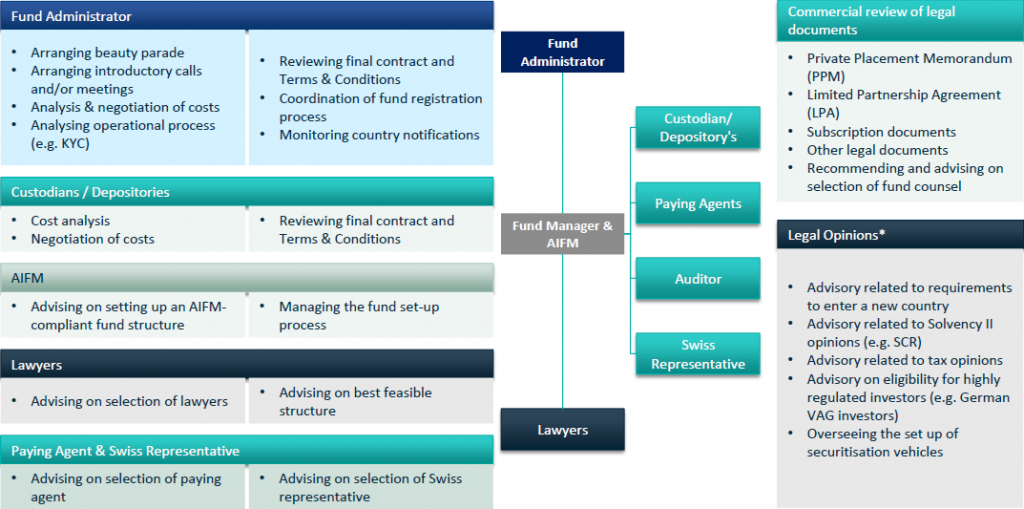

II) FUND STRUCTURING

One stop solution for advisory on efficient fund set up – Ensuring to have a structure which is eligible for European

institutional investors.

* For the avoidance of doubt, legal opinions will be provided by third parties (lawyers, tax consultants, solvency consultants, etc.).

III) MARKET POSITIONING

ORGANISATIONAL AND TEAM STRUCTURE

• Advising on the optimal organisational and team structure for the fund to succeed in the European fundraising market.

• Assessing the current structure and making recommendations to align it with market demands and investor expectations.

• Identify key roles, define reporting lines, and establish an effective team composition to enhance the fundraising efforts.

VALUE PROPOSITION DEVELOPMENT

• Advising in developing a strong value proposition that effectively communicates the fund’s benefits and value to investors.

• Advising on articulating the fund’s investment philosophy, track record, risk management approach, and other factors that differentiate it from competitors. Ultimately ensuring that the value proposition resonates with target European institutional investors.

BRAND POSITIONING

• Identify and recommend ways to position the brand and fund to the European investor market.

• Conduct a thorough analysis of market dynamics, investor preferences, and competitive landscape to develop a strategic positioning approach that aligns with the fund’s investment objectives, strategies, and strengths.

COMMUNICATION AND MESSAGING

• Creating a strong brand identity and messaging that resonates with the target institutional investor groups.

• Developing a compelling brand story, designing a visually appealing brand identity, and crafting clear and impactful messaging that effectively communicates the fund’s unique value proposition.

IV) 5-PILLARS OF SELECTION

DCPLA has developed a proprietary Manager Due Diligence Toolkit that will provide unparalleled insights into the strengths, challenges, and gaps of a fund manager – Ultimately helping make smarter fundraising choices.

Investment

Team

Investment

Strategy & Process

Track

Record

Organisation, Compliance & Client Reporting

Competitive Advantage & Fundraising

✓ Experience and Composition

✓ Length of time together as a team

✓ Depth of management

✓ Management turnover and succession

✓ Deal Sourcing

✓ Investment opportunity, strategy & consistency of implementation

✓ Investment process

✓ Operational model

✓ Value creation

✓ Risk management

✓ Quantity of track record

✓ Quality of track record

✓ Depth of track record

✓ Quality of unrealised portfolio

✓ Reputation and investor base

✓ Organisational structure & development

✓ ESG Policy

✓ Client Services

✓ Competitive Landscape

✓ Terms & Conditions

✓ Investor appetite and fundraising status

V) NAILING THE PITCH (MARKETING MATERIALS)

TEASER

MANAGEMENT PRESENTATION

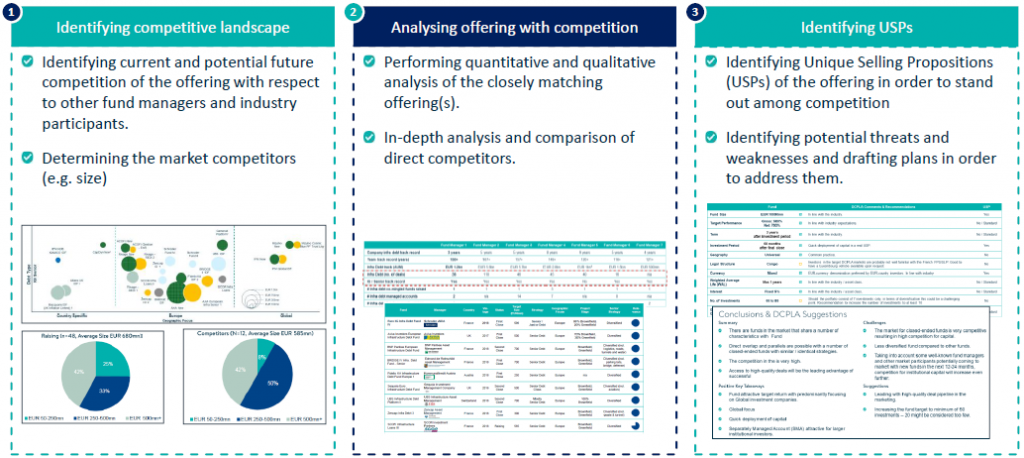

VI) COMPETITIVE & BENCHMARKING ANALYSIS

Understanding the competition in the market in order to meet the requirements to be the top funds.

VII) DATA ROOM

Advising on all relevant documents to ensure are in place in a well structured data room for a smooth investor due diligence.

Advising on structure of data room including detailed description of documents to be included in the data room.

In depth review of existing data room & advising on missing relevant documents or information.

Advising and assisting in selection of data room.

Advising on the inclusion of relevant documents and assisting in obtaining / creating / updating missing documents.

VIII) DUE DILIGENCE QUESTIONNAIRE

Streamlining investor due diligence process.

Challenges

Solutions

Due diligence questionnaires structured by fund manager are generally not investor friendly and lack main aspects which investors are looking for.

< Investor-friendly >

Advising on the whole due diligence questionnaire including the questions and the structure and ensuring it is investor friendly.

Due diligence questionnaires are generally vague and filled with inaccurate and unnecessary information, leading to confusion among investors.

< Accurate >

Advising on the whole due diligence questionnaire including the questions and the structure and ensuring it is investor friendly.

Due diligence questionnaires are not structured in a logical way and contain formatting errors.

< Presentable >

Providing a detailed structure solution in order to make the due diligence questionnaire more presentable to investors.

Due diligence questionnaires are filled with repetitive information which is sometimes inconsistent with other fund documents.

< Consistent >

Making sure that the information in the due diligence questionnaire is in line with other fund documents.

IX) TRACK RECORD (ADVISORY)

Effectively showcasing a fund manager’s investment performance, expertise, and historical achievements to attract capital commitments and strengthen the reputation in the market.

Firm Track Record

Past Track Record

Individual Track Record

SMAs and Club Deals

Direct Deals

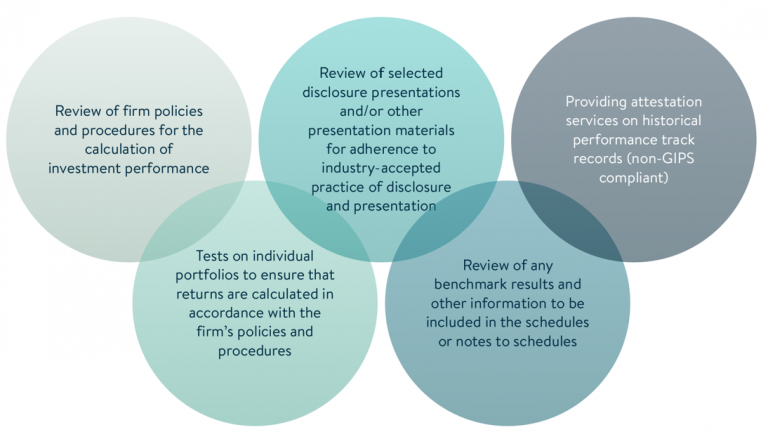

X) TRACK RECORD (VERIFICATION)

Institutional investors are often reluctant to allocate capital to investment managers without a historical track record of their performance.

XI) SUSTAINABILITY

Unmatched expertise in increasingly important investment dimension – Making fund selectable for ESG-sensitive investors.

ESG assessment of the firm and/or the department and/or the product

Advising on ESG marketing materials to meet the highest standards among instutitonal investors

Analysing and identyfing potential weaknesses and USPs

Reviewing and analysing the findings of ESG due diligence

Advising on partnerships with ESG associations, in order to broaden the reach of the ESG programm

Advising on preparation for SFDR Art 8. or Art. 9. Be on top of the ESG – sensitive investor´s list for selection – get best prepared & leverage our unmatched marketing expertise to demonstrate and strengthen your ESG involvement

UNLEASHING THE FUNDRAISING POWER

Functional Always active

Preferences

Statistics

Marketing

Read about how we use cookies and how you can control them here. Continued use of this site indicates that you accept this policy.OKPrivacy Policy