DISTIBUTION COVERAGE

Broad distribution to a diversified investor base

DISTIBUTION COVERAGE

Broad distribution to a diversified investor base

FOCUS ON THE KEY EUROPEAN

AND EMERGING ASIAN & PACIFIC INVESTOR MARKETS

Structured distribution process with top-down/key-account approach and responsibilities of team members

Regular communication and update with institutional investors on their investment preferences, asset allocation and current portfolio development

Presence at the largest industry relevant events, roundtables and conferences

INTERNATIONAL DISTRIBUTIONAL COVERAGE

DC Placement Advisors’ distribution capacity spans from key European and Asian—especially South Korea and Japan to the Middle East—investor markets with a dedicated approach. Together with our regional partners we are currently raising EUR ~4.3bn* for our clients.

-

Germany, Switzerland, Austria (DACH)

-

France, Belgium, Luxembourg

-

Netherlands

-

UK

-

Nordics

-

Italy, Spain and Mediterranean Europe

-

Middle East

-

Israel

In cooperation with Meitay Dash, Israel

-

Japan

In cooperation with local business partners

-

South Korea

In cooperation with local business partners

DCPLA’S DISTRIBUTION CAPABILITIES

-

Focus on largest institutional investors in alternatives

Comprehensive database of 2,800+ global institutional investors and their investment consultants; focus on 800 largest European investors.

-

Key senior decision makers approach

Key investment roles at pension funds, insurance companies, funds of funds, investment consultants, asset managers, family offices and sovereign wealth funds.

-

Perfectly positioned to cover “hard-to-access” markets

German-speaking Europe, France, Netherlands, South Korea, the Middle East and Japan.

-

Focus on largest institutional investors in alternatives

Comprehensive database of 2,800+ global institutional investors and their investment consultants; focus on 800 largest European investors.

-

Key senior decision makers approach

Key investment roles at pension funds, insurance companies, funds of funds, investment consultants, asset managers, family offices and sovereign wealth funds.

-

Perfectly positioned to cover “hard-to-access” markets

German-speaking Europe, France, Netherlands, South Korea, the Middle East and Japan.

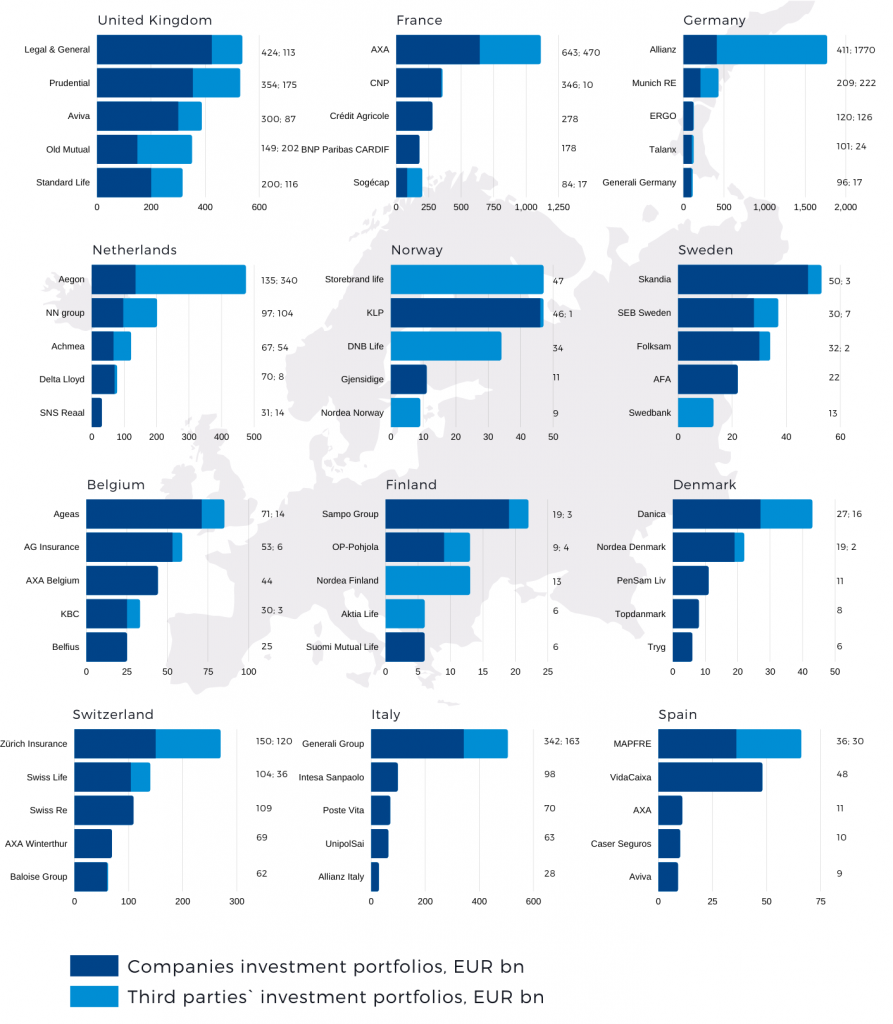

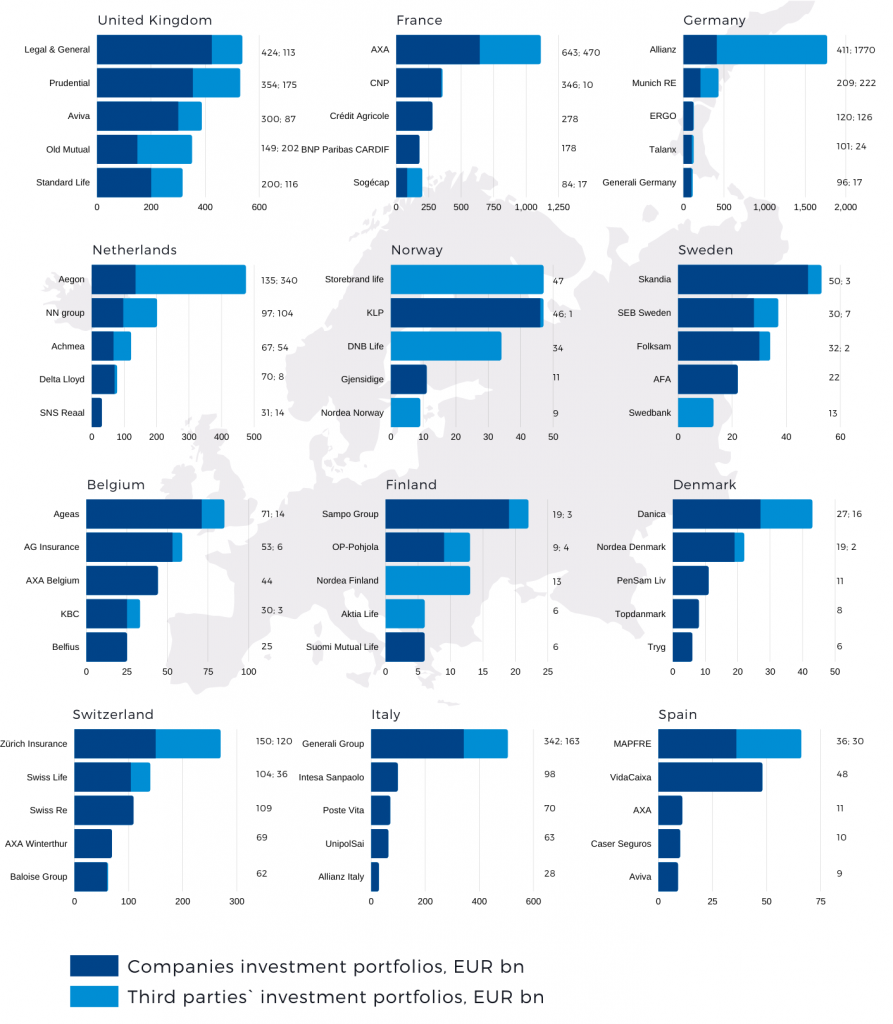

EUROPEAN PENSION & INSURANCE MARKETS 2018 (BILLION EUR)

Source: OECD; Willis Towers Watson “Global Pension Asset Study – 2018”

“Over the course of 12 years, DC Placement Advisors has been successfully placing funds for global leading asset managers in Europe, Australia and Asia and has expanded its reach to global coverage.” –

Nina Dohr – Pawlowitz, CEO

“Over the course of 12 years, DC Placement Advisors has been successfully placing funds for global leading asset managers in Europe, Australia and Asia and has expanded its reach to global coverage.” –

Nina Dohr – Pawlowitz, CEO

INVESTOR MAPPING AS A KEY DISCIPLINE

DC Placement Advisors is perfectly positioned to cover the core European institutional investor markets as well as South Korea, the Middle East, and Japan representing more than €7trn of pension and insurance assets.

By continuous communications with the investors base, DCPLA’s team of multilingual relationship managers ensures that our investor data are as complete as possible, both through monitoring news sources, and most importantly through proactively contacting alternative assets professionals and senior decision makers directly in order to ensure that information is accurate and up to date.

Our database covers the following regions (UK, Germany, Switzerland, Austria, France, Benelux, Nordics, Mediterranean Europe, South Korea, the Middle East, Japan and others).

INVESTOR MAPPING AS A KEY DISCIPLINE

DC Placement Advisors is perfectly positioned to cover the core European institutional investor markets as well as South Korea, the Middle East, and Japan representing more than €7trn of pension and insurance assets.

By continuous communications with the investors base, DCPLA’s team of multilingual relationship managers ensures that our investor data are as complete as possible, both through monitoring news sources, and most importantly through proactively contacting alternative assets professionals and senior decision makers directly in order to ensure that information is accurate and up to date.

Our database covers the following regions (UK, Germany, Switzerland, Austria, France, Benelux, Nordics, Mediterranean Europe, South Korea, the Middle East, Japan and others).

Our investors base covers the following investor types:

-

Asset Management Firms

-

Banks (Savings and Regional Banks)

-

Church Investors

-

Investment Consultants/Advisors

-

Corporate Investors

-

Corporate Pension Funds

-

Family Offices

-

Fund-of-Funds Managers

-

Gatekeepers

-

Insurance Companies

-

Public Pension Funds

-

Sovereign Wealth Funds

We speak to the following audiences:

-

CIO

-

Investment Director

-

Investment Manager

-

Head of Department

(Private Equity, Real Estate, Real Assets etc..)

-

Portfolio Manager

-

Pension Fund Manager

-

Head of Alternatives

-

Head of Fund Research

*Notes:

1. Using hard cap if available

2. EUR/USD = 0.92 (as of 24.03.2020, 12:42 UTC)